In short, social contributions ensure your social rights: when you’re self-employed you need to register yourself with a social insurance fund and you will need to start paying your social security contributions.

Nobody is exempted from paying social security but as a self-employed, you’re reminded to pay every three months to support you in key moments of your life. They will amount to around 20.5% of your annual income.

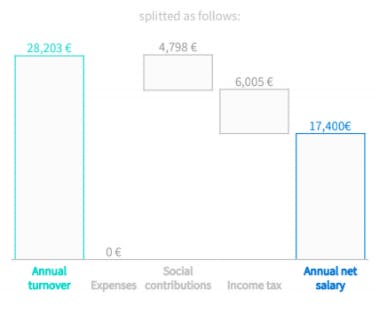

Example of how social contributions and income tax make up an annual turnover of €28,203

Indeed, tax authorities will communicate to your social insurance fund your actual revenues. Based on that calculation, the social insurance fund will ask you to pay extra or reimburse part of what you paid, if your payments did not match the required threshold.

That calculation happens two to three years later. You may then face a (potentially bad) surprise. Your accountant will help you optimize your social contributions to pay and will help you to avoid these potentially bad surprises.

Best is to check in real-time whether you are paying the adequate amount. You can do so within the Accountable app.