Deliver with Deliveroo

Make money on your own schedule with a scooter or with a bike. Earn even more as a self-employed rider, with fee boosts and incentives.

Ride when you want to

Ride when you want to

Earn great money

Earn great money

Get round-the-clock support

Get round-the-clock support

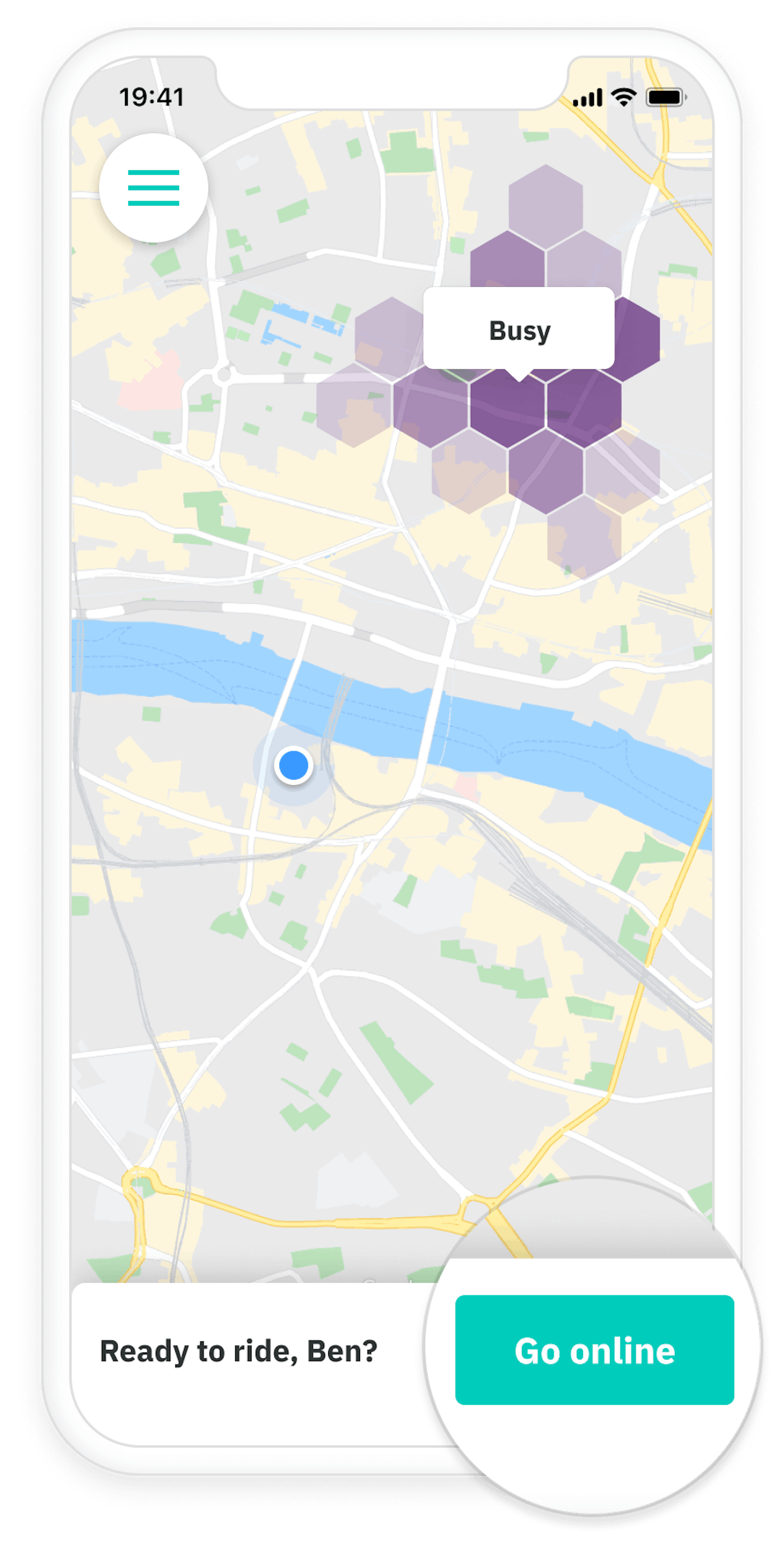

Use your app to go online when you want and in the area of your choice, within our opening hours. While you’re online, we can send you orders to deliver. Stay online for as long as you like – it’s all up to you.

When you’re on the road, we’re with you – for help, advice and support, message or call us in the app. Your safety is our priority, so we’ll insure you in case of accidents, too. It’s totally free and applies from the moment you go online.

We pay a competitive fee for each order you deliver. You can earn tips from customers too, to help towards your earnings goals.

Take advantage of busy areas and earn more at evenings and weekends.

Our support teams are always with you. We offer equipment as well as free accident cover when you’re on the road.

We’ll transfer your earnings each week.

Highly visible, comfortable and breathable gear, suitable for the climate you’re riding in.

We’re one of the busiest food delivery platforms in the country, delivering orders in your local area every day.

While riding with Deliveroo, you are covered by our free insurance for accidents and public liability, plus earnings support when you’re ill or a new parent.

As a self-employed rider, you get free access to hundreds of online learning courses, fuel discounts, deals on vehicle and safety equipment and special offers.

Once you’ve joined Deliveroo, here’s what to expect.

To ride with Deliveroo you’ll need:

You must also:

One document to prove your right to work in Belgium, which could be:

If you’re applying to ride as independent/student independent you need to have:

If you’re applying to ride with a scooter or a car you’ll also need to have:

For scooters and other vehicles above 25km/h, on top of our insurance you will also need your own public liability insurance.

As a rider riding with Deliveroo, you are insured when you hit the road. This insurance covers you or your substitute (if you have someone else riding with your rider app, he/she will be covered too). You will be insured when you are connected to the Deliveroo app and up to an hour after you have logged out.

Click here to make an accident report.

For riders on bike or electric bike:

For riders of moped A, moped B, scooters and cars

Qover does not intervene in the following situations:

Trouble with your phone – clothing problems – problems with your bike, electric bike, scooter or car – when you are off duty.

Click here to read the general terms and conditions.

Do I need to have additional personal insurance or does Deliveroo cover everything?

It depends on your vehicle. As you can see at the top of the page, riders owning a bike or electric bike are covered by Deliveroo’s Qover Insurance for public liability and personal injury.

For mopeds A, mopeds B, scooters and cars, you must have a public liability insurance that mentions use of your vehicle for professional activities.

How do I know if I have the right personal liability insurance for Deliveroo?

When registering (or changing a vehicle as) a scooter or a car with Deliveroo, we can not guarantee that you are in possession of the correct insurance. It's up to you, when you fill out the registration form, to check it beforehand with your insurance company. You can find the information in your insurance policy or ask them if your insurance contains a clause that allows you to deliver food by scooter or by car as a professional activity. If you check the box without being sure that you have the right insurance policy, you take the risk of not being covered by your insurance in case of accident, which can cost you a lot.

For more information, call Qover at +32 (0) 2 588 25 50 or contact them by email: deliveroo@qover.com.

Riders get paid for each delivery they make. The exact delivery fee is different per status.

For independent or student independents the fee varies per order and includes a variable distance fee.

For P2P the delivery fee is fixed per or depending on the city you ride in. You will be told of the delivery fee payable before you accept the order.

Fees are paid weekly on a Wednesday.

Riders keep 100% of any tips they receive and these are paid at the same time as the rest of your fees.

Once you’ve joined you can order a professional kit from the Deliveroo Kit Store. Here’s what you can get once you’ve joined Deliveroo:

Bicycles

Scooters & cars

You’re not required to wear Deliveroo branded kit when on the app or delivering for Deliveroo. You’re welcome to buy a kit from a supplier of your choice but your kit will need to meet our minimum safety standards.

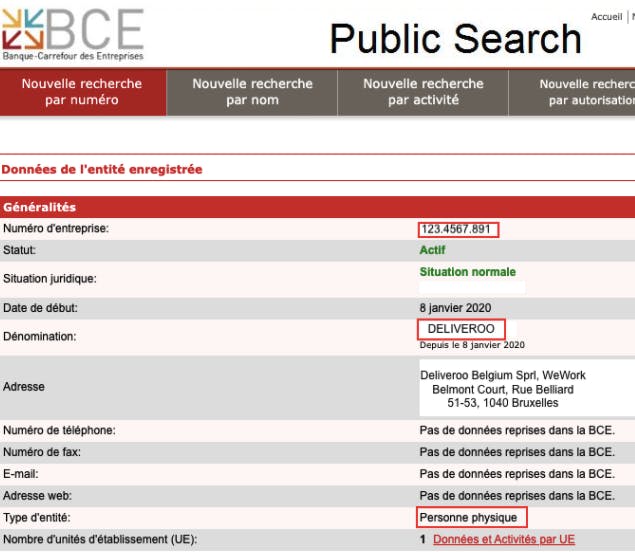

This is a status for which it is necessary to take some steps outlined below to request an enterprise number. The enterprise number you create must meet the following conditions:

Please take your time to read the below sections on how to become self employed and if you have any questions our partners Acerta and Accountable can help you for all steps of registration as a self employed!

Once your enterprise number is created with the right conditions you can register as a self-employed via https://deliveroo.be/en/apply Don’t forget to choose the self-employed status.

Switching from P2P once your enterprise number has been created as explained in this guide, you can contact us using this typeform. It may take several days before your enterprise number is active. We can’t accept this until it is active before continuing your registration as a self-employed person.

Getting the right licence

To become self-employed you need to be able to prove that you have enough basic knowledge on how to operate and run a business. Without this proof, you will not be able to register your company at Crossroads Bank for Enterprises.

Note: If you are living in Flanders, you are in luck and can skip to Step 2 : as of September 1st, 2018, you do not need to demonstrate basic management knowledge to start a business.

So, how can you demonstrate this knowledge?

Open a bank account

If you don’t already have one, you will need a bank account where you can receive payments from us.

Creating your enterprise number with the crossroads bank for enterprises (CBE)

This is the core step of the process and it’s the basis of your relationship with the State as a self-employed worker.

The registration with the CBE will cost you a one-time payment of 89,50 euros.

Our partner accountable can help you with this or you can register yourself here, most social security funds can help you too.

Social contributions

As a self-employed, you also need to affiliate yourself to a social security fund. You can choose any of these social security funds.

The fund that you choose will take care of family allowances, child benefits, your (small) pension as self-employed and some safety net in case of e.g. bankruptcy.How much you need to pay for this fund depends on how much you are earning.

Social contributions amount to around 20.5% of your taxable income. By using our partner accountable, their app calculates the exact amount you should pay, based on your actual revenues.

If you want to know more about social contributions please see our section below.

Obtaining a VAT number

As a self-employed, you might obtain a VAT number and become liable to VAT. In Belgium, that number is the same as your company number with BE in front.

The VAT is actually simple: it is a tax you collect from your customers and pay back to the government, typically on a quarterly basis. You can also claim the VAT back from certain professional purchases.

If you want to get a VAT number for your business you can do so by filling in this form.

You can also do it via Accountable: their partnership with Xerius allows you to fully start as a self-employed, including receiving your VAT number, via your smartphone. Many social security funds will also help with this.

When your turnover is below €25.000, you can also choose to be exempted from VAT. In that case, no need for you to file the VAT declaration every quarter. You only need to submit a listing of clients on a yearly basis, by March 31st.

For more information on V.A.T please see our section below.