This is a status for which it is necessary to take some steps outlined below to request an enterprise number. The enterprise number you create must meet the following conditions:

Please take your time to read the below sections on how to become self employed and if you have any questions our partners Acerta and Accountable can help you for all steps of registration as a self employed!

Once your enterprise number is created with the right conditions you can register as a self-employed via https://deliveroo.be/en/apply Don’t forget to choose the self-employed status.

Switching from P2P once your enterprise number has been created as explained in this guide, you can contact us using this typeform. It may take several days before your enterprise number is active. We can’t accept this until it is active before continuing your registration as a self-employed person.

Getting the right licence

To become self-employed you need to be able to prove that you have enough basic knowledge on how to operate and run a business. Without this proof, you will not be able to register your company at Crossroads Bank for Enterprises.

Note: If you are living in Flanders, you are in luck and can skip to Step 2 : as of September 1st, 2018, you do not need to demonstrate basic management knowledge to start a business.

So, how can you demonstrate this knowledge?

Open a bank account

If you don’t already have one, you will need a bank account where you can receive payments from us.

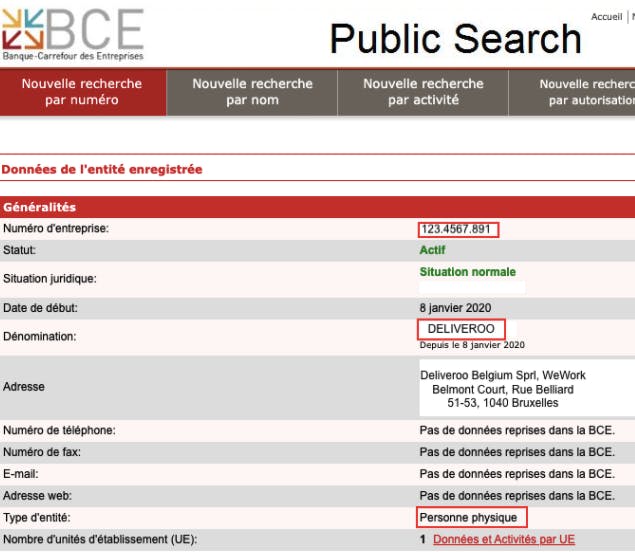

Creating your enterprise number with the crossroads bank for enterprises (CBE)

This is the core step of the process and it’s the basis of your relationship with the State as a self-employed worker.

The registration with the CBE will cost you a one-time payment of 89,50 euros.

Our partner accountable can help you with this or you can register yourself here, most social security funds can help you too.

Social contributions

As a self-employed, you also need to affiliate yourself to a social security fund. You can choose any of these social security funds.

The fund that you choose will take care of family allowances, child benefits, your (small) pension as self-employed and some safety net in case of e.g. bankruptcy.How much you need to pay for this fund depends on how much you are earning.

Social contributions amount to around 20.5% of your taxable income. By using our partner accountable, their app calculates the exact amount you should pay, based on your actual revenues.

If you want to know more about social contributions please see our section below.

Obtaining a VAT number

As a self-employed, you might obtain a VAT number and become liable to VAT. In Belgium, that number is the same as your company number with BE in front.

The VAT is actually simple: it is a tax you collect from your customers and pay back to the government, typically on a quarterly basis. You can also claim the VAT back from certain professional purchases.

If you want to get a VAT number for your business you can do so by filling in this form.

You can also do it via Accountable: their partnership with Xerius allows you to fully start as a self-employed, including receiving your VAT number, via your smartphone. Many social security funds will also help with this.

When your turnover is below €25.000, you can also choose to be exempted from VAT. In that case, no need for you to file the VAT declaration every quarter. You only need to submit a listing of clients on a yearly basis, by March 31st.

For more information on V.A.T please see our section below.